If you want to operate power bank rental business, you need open a merchant account from payment gateway.

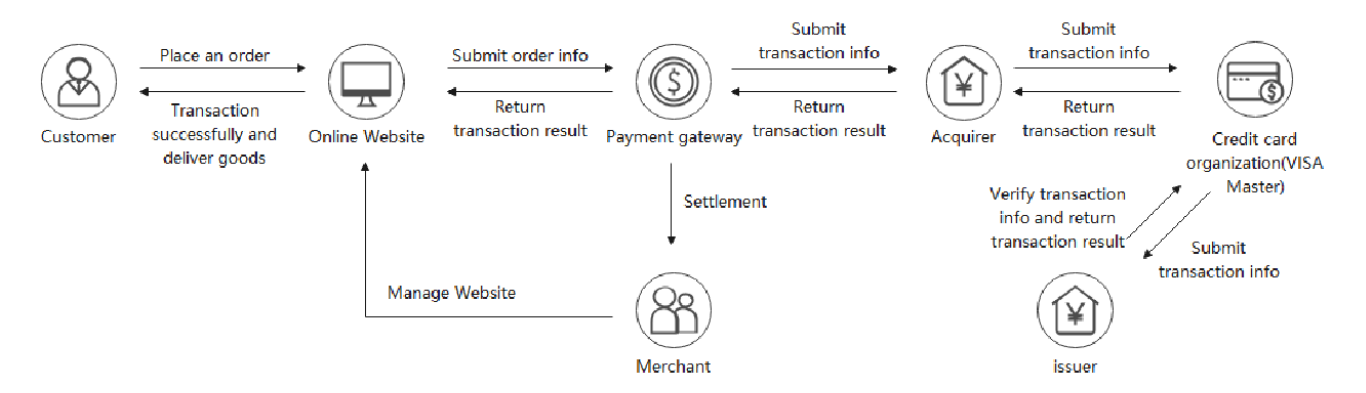

The following diagram describe what is happening when customer buy goods from online website like amazon.

A payment gateway solution is a service that authorizes credit card payments and processes them on behalf of the merchant. Through Visa, Mastercard, Apple Pay, or money transfers, the gateway enables more payment options for users and businesses.

When setting up your payment gateway, you will be required to set up a merchant account. This type of account allows you to process credit card payments through the payment gateway and receive those funds back into your bank account.

An integrated payment gateway is embedded into your app through payment APIs, which makes for a seamless user experience. This type of gateway is also easier to track, which can be helpful for conversion rate optimization.

Your users should be able to pay for power bank rentals from your app. For this, you need to integrate a payment gateway. A payment gateway will process all payments that go through your app. We usually advise Stripe, Braintree, or PayPal, but there are dozens of payment providers to choose from. You can go with a local payment gateway that has options suitable for your audience.

Many power bank applications implement their own internal currency so that users replenish their balances with at least a fixed minimum amount and then use the balance for rentals. This is more profitable for the business, as it lowers the payment gateway fees.

How to Choose the Right Payment Gateway for Your App

Now that you know the basics of payment gateways, here are a few things to remember as you compare providers.

1.Identify your requirements

The first step is to understand your needs. Do you need to support multiple currencies? Do you need recurring billing? What app frameworks and languages do you need the gateway to integrate with? Once you know what features you need, you can start to compare providers.

2.Know the costs

Next, take a look at the fees. Payment gateways typically charge setup fees, a per-transaction fee, and some also have annual or monthly fees. You’ll want to compare the total cost of each provider to see which one is the most affordable.

3.Evaluate the user experience

Consider the user experience. The payment gateway services you choose should offer a smooth checkout experience and make it easy for your customers to pay. It should also be easy for you to track conversions and manage your payments.

Post time: Jan-18-2023